flow through entity private equity

Basic US Tax Regime. Blocker corporation rather than a US.

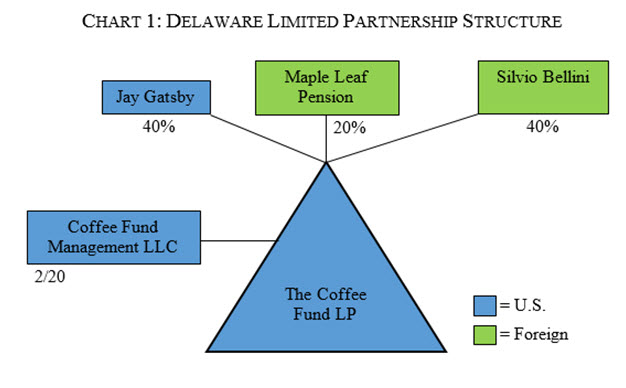

Private Equity Fund Structure A Simple Model

Some of the most active investors in private equity funds are.

. Indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below. When a PE firm structures an LBO transaction some PE investors generally tax-exempt and foreign investors will invest directly or indirectly in portfolio company equity. Trade or business flow-through operating entities.

A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible. As the private equity industry has maturedhoweverthe core under-lying assumptions regarding a management companys value and operations have proven to be inaccurate. A private equity or hedge fund located in the United States will typically be structured as a limited partnership due to the lack of an entity-level tax on partnerships and other flow-through.

Private Equity Funds are a way to make sure that there is a transfer of ownership of the South African economy into the hands of Black people. Need to invest through a parallel fund that excludes tainted income or have the right to opt-out of certain investments if the government investor is a controlled entity. States real property interests USRPIs or interests in flow-through entities themselves engaged in a US.

In this stage of the private equity investment process flow chart the deal team typically interacts with the investment bank and the management of the target company on a daily basis. Under US tax law partnerships are flow-through entities aka tax transparent Generally not subject to US federal income tax at partnership level Partners. 2 LPs and LLCs are pass-through entities for federal income tax purposes.

As a result only the individuals not the business are. In addition the non. Raising a private equity fund requires two groups of people.

A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. They encourage the creation and. Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US.

What Is Private Equity Deal Structure Flow Process Guide

Private Equity Faces Crisis Of Value Over Inflated Prices Bloomberg

Notre Dame Reports 3 8 Billion In Investments In Central America And The Caribbean Zach Klonsinski

Tax Considerations In Structuring Us Based Private Equity Funds Iflr

From Philanthropy To Social Investment Funding The Ecosystem Bny Mellon Wealth Management

Taxation Of Private Equity And Hedge Funds Wikipedia

Private Equity Fund Structure A Simple Model

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

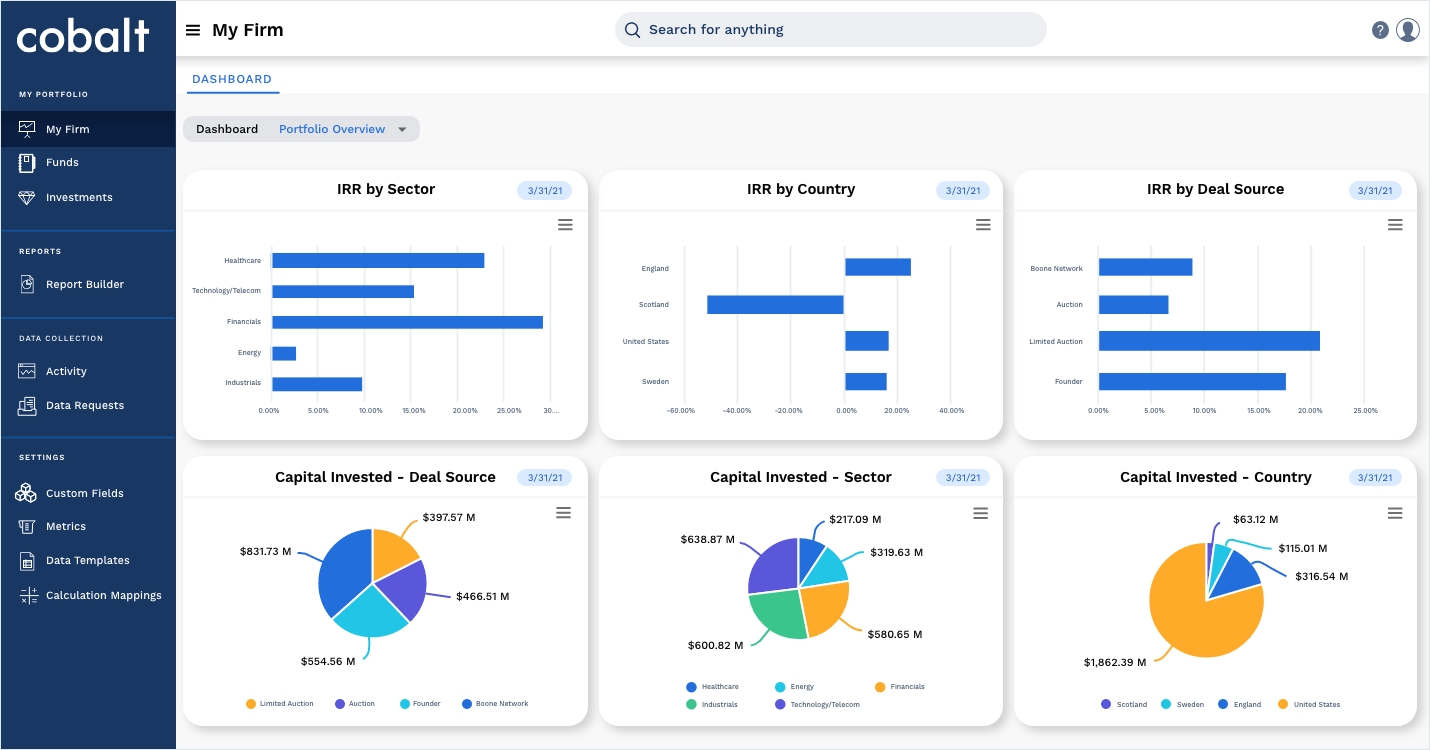

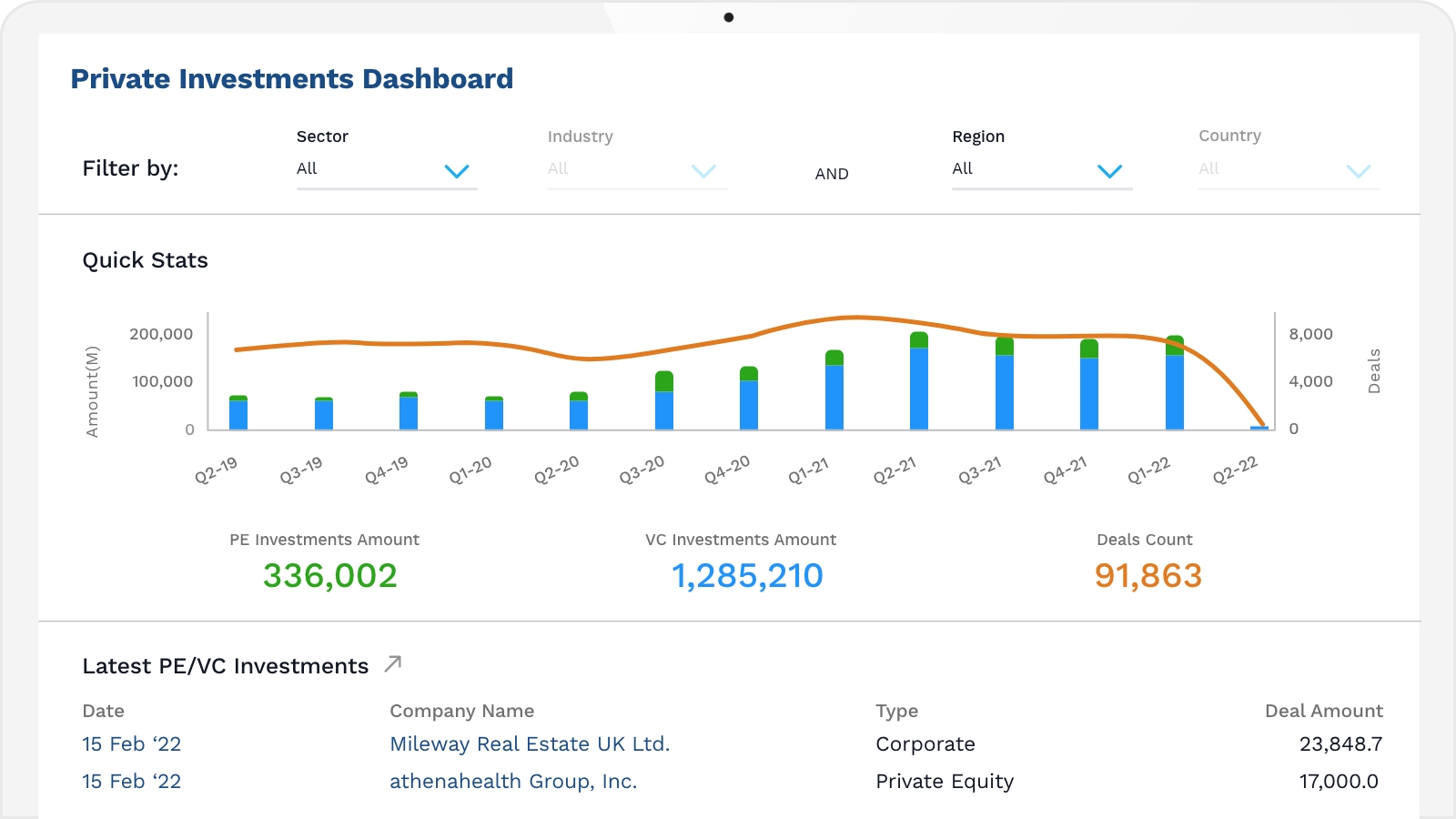

Private Equity Venture Capital Factset

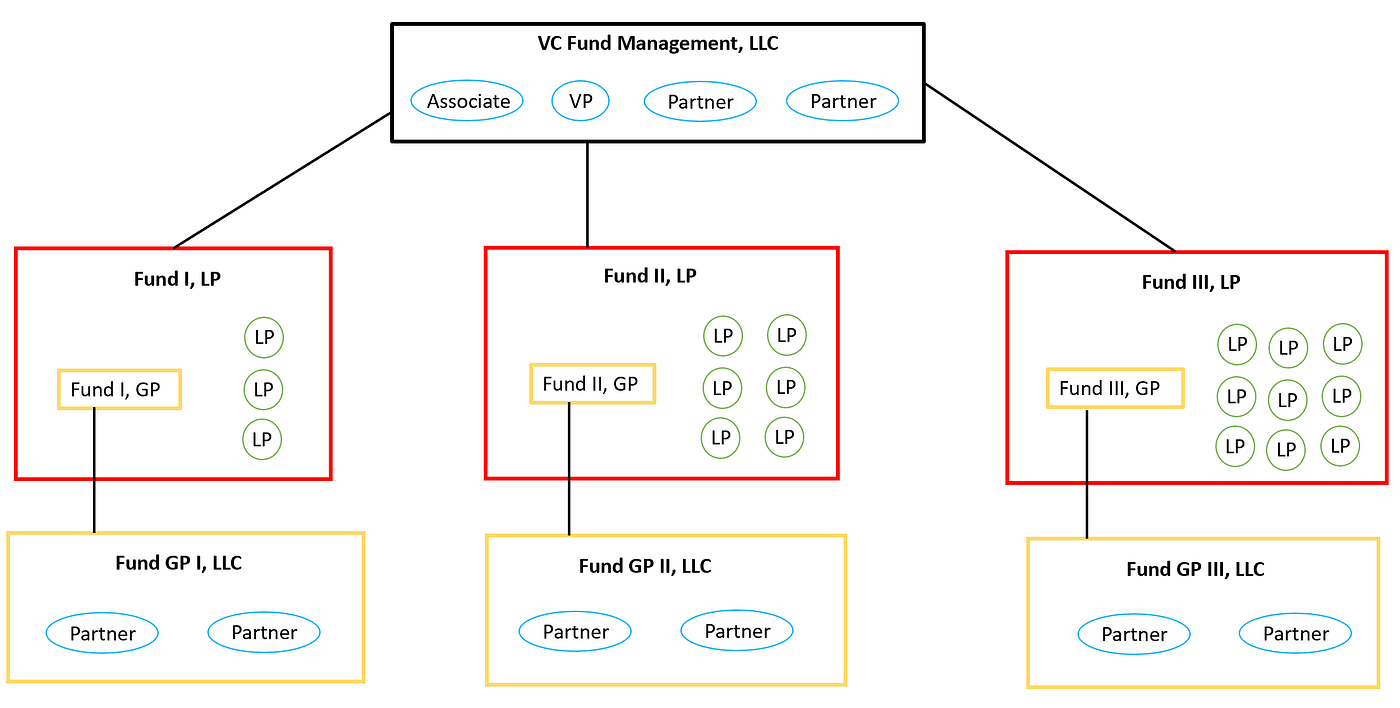

A Look Under The Hood Of Venture Capital Firms By Trey Calver Medium

Double Taxation Of Corporate Income In The United States And The Oecd

Private Equity Venture Capital Factset

Preview Private Fund Formation Imdda

/GettyImages-687054066-c550851609794d5bb4f536175016e9ce.jpg)

How Private Equity And Hedge Funds Are Taxed

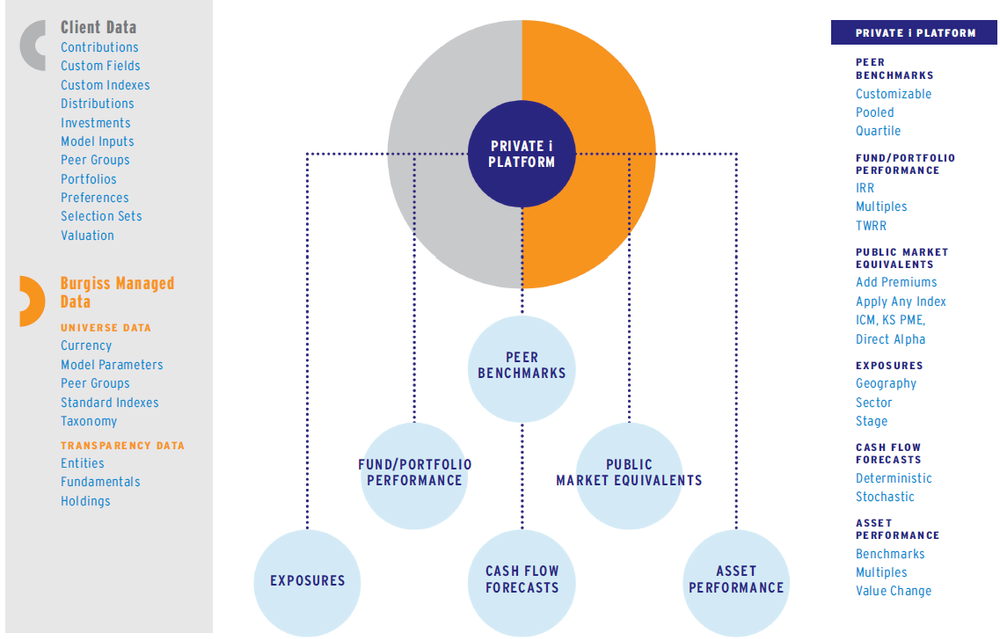

The Private I Platform Burgiss

Start Soul Searching Calpers Cio Tells Private Equity Chief Investment Officer

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

4 Types Of Business Structures And Their Tax Implications Netsuite